The White House reveals an interactive card showing Trump’s bills of invoices by state

NEWYou can now listen to Fox News articles!

First on Fox: The White House has launched an interactive United States card showing the savings that Americans can expect from initiatives under the direction of President Donald Trump One Big and Bill Bill Bill on a state by state, Fox News Digital learned on Tuesday.

Trump signed the massive law in the law on July 4, praising that his tax reductions will make the American economy similar to a “rocket” while the Americans begin to feel its effects.

Tuesday, the The White House has published an interactive map Of the 50 states, which provides breakdowns of the quantity of Americans who can expect to save and see in their portfolios compared to if the bill had not been adopted and signed.

The interactive card has focused on data such as: increased wage increases, which are understood as the increase in worker’s income after taking inflation into account; The actual wage increase in a family; How many elderly people benefit from non-tax on Social Security; The percentage of the active population of a state which should benefit from not paying tax on tips; The number of jobs protected in a state and other data.

Trump signs the big and handsome ‘invoice in victory to sweep the program for the second mandate, overcoming the GOP DEMS and rebels

President Donald Trump joined the Republican legislators to adopt massive legislation bringing up the agenda of his administration. (Evan Vucci / The Associated Press)

In California, the country’s most populated state, residents can expect a real salary increase of $ 4,900 to $ 8,800 and a real $ 8,500 salary increase to $ 1,2,500 for a typical family with two children, the MAP.

“A typical family with two children in California can expect to see a wage to take away from around $ 8,500 to $ 1,2,500 with OBBB compared to if it has not been adopted,” said the card, which includes links to more detailed data on a given state. “About 4% of the workforce is employed in professions that would likely benefit from taxes on OBBB tips.

A screenshot of the La Maison Blanche card was deployed on July 15, 2025, showing the expected savings that the Americans will see after the adoption of the “Big Beautiful Bill”. (White House)

Steve Moore: Trump has just scored the greatest conservative victory in three decades

Residents in a heart of the heart such as Nebraska can expect a real salary increase of $ 3,700 to $ 6,600 and a real increase in wages to take away for a typical family with two children from $ 7,300 to $ 10,300. The card also praises 300,000 elderly people in the state of Cornhusker should benefit from the lack of tax on social security, and 29% of the state labor should benefit from the lack of tax on overtime.

On the east coast, New Jersey residents can expect actual salary increases from $ 5,000 to $ 9,000, and a real $ 8,600 wages to $ 8,600 for typical families with two children, according to data examined by Fox News Digital. New Yorkers can expect a real salary increase of $ 4,400 to $ 8,000 and a real take-out salary increase from $ 8,000 to $ 11,700, according to data.

Trump had gathered Republican legislators to adopt the legislation since the first days of his administration this year, because it increases its program on taxes, immigration, energy, defense and national debt.

The president of the room, Mike Johnson, played a central role by adopting the great and beautiful law on the signing of Trump on July 4, 2025. (Images Kevin Dietsch / Getty)

The Republicans of the Chamber and the Senate delivered legislation to the Trump office in July after a harshly disputed battle which included a handful of republicans who join the Democrats in their condemnation of the bill, mainly on its increase in the limit of debt.

A handful of Republicans, such as representative Thomas Massie from Kentucky and Senator Rand Paul of Kentucky, voted against the respective versions of their bill of the bill because of his increase of $ 5,000 billion at the limit of debt. Trump Elon Musk’s former ally also broke with the president about the bill, calling for legislators to “kill the bill” when he made his way through the congress because of his increase in the ceiling of American debt.

The bill has finally adopted and includes key provisions to constantly establish individual and commercial tax alternatives included in the Trump 2017 Trump and Jobs Act, and incorporates new tax deductions to reduce rights to advice and overtime. He also cancels certain green energy tax credits from the Biden era, allocates around $ 350 billion for defense and Trump’s mass deportation efforts and institutes Medicaid reforms.

The White House hands the calculator of the Americans Big Beau

“We officially rendered the permanent Trump tax discounts,” Trump said at the signature ceremony. “It is the greatest tax reduction in the history of our country.

The new screening reports good news for families, workers of the Big “ and beautiful bill ” of Trump ‘

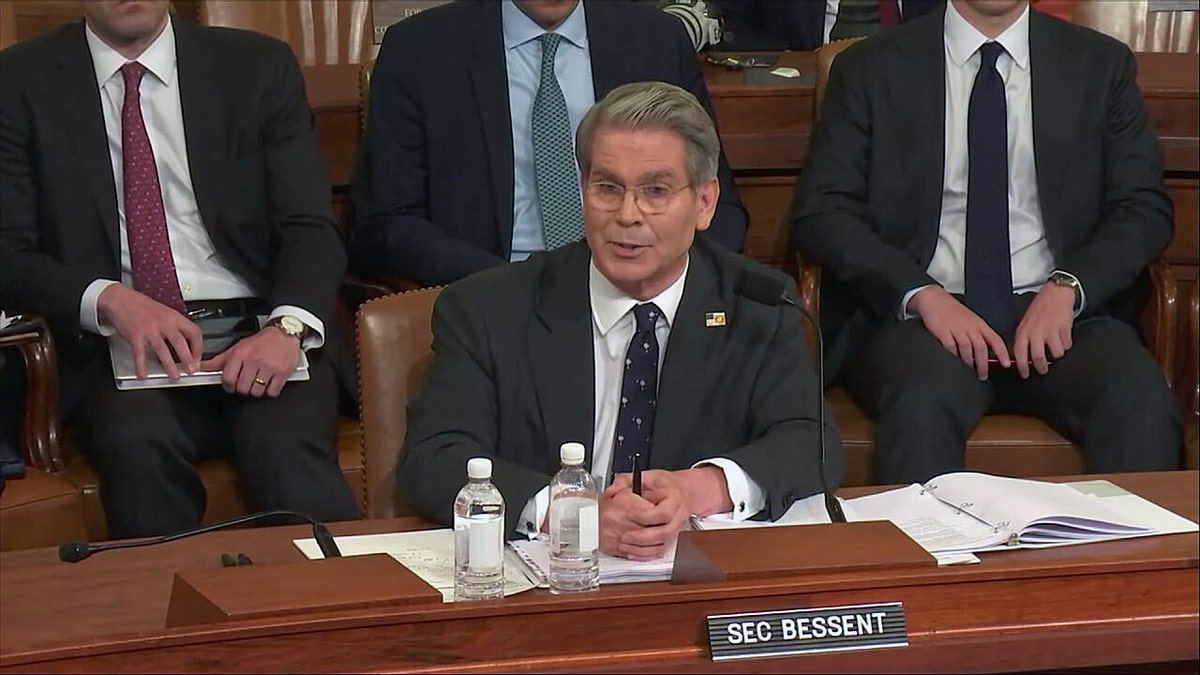

The Treasury Secretary, Scott Bessent, praised the bill in an opinion article published on Fox News Digital earlier in July, celebrating that Americans can expect to keep “$ 4,000 at $ 7,200 in real annual wages”.

The secretary of the Treasury, Scott Bessent (Pool)

“The bill Prevents an increase in taxes of 4.5 billions of dollars In the American people, “he wrote in an editorial published on July 4.” This will allow the average worker to keep an additional $ 4,000 at $ 7,200 in annual real wages and will allow the average family of four $ four of $ 7,600 to $ 10,900 in take -out wages. Add to that the ambitious deregulation program of the president, which could Save the average family of an additional $ 10,000. For millions of Americans, these savings make the difference between being able to make a mortgage payment, buy a car or send a child to university. “”

Click here to obtain the Fox News app

“The Big Beautiful Bill also does not codify any tax on advice and no tax on overtime remuneration-the two policies designed to provide financial relief to the American working class,” he added. “These fiscal alleviations will guarantee that the main workers on the street will keep their income hard won more. And they will strengthen productivity by rewarding Americans who work overtime. All Americans can learn how President Trump’s tax reductions will have an impact on their lives for the best with a new White House calculator.”

Diana Stancy and Aleandra Koch of Fox News Digital contributed to this report.