The Treasury Department shares 68 jobs probably eligible for any tax on the deduction of advice

NEWYou can now listen to Fox News articles!

The Treasury Department announced the Labor Day that nearly 70 jobs in eight sectors could benefit from the tax reduction of President Donald Trump on slope wages, a campaign promise he reported this summer.

Workers who can expect to stop paying taxes on rocking wages within the framework of A great act of bill Include those of the food and drinking industry, the event and entertainment sector, hospitality and customers, personal services, personal appearances and well-being jobs, home services, leisure and instructions and delivery and transport jobs.

A preliminary list describes the 68 jobs which “received advice usually and regularly” at the latest on December 31, 2024 and are likely to qualify to “no tax on advice” included in the megabill of Trump, which narrowly crossed the Congress this summer.

The Treasury Department said that an official list will then be open to public comments. People in the fields of arts and sports of the show and sports areas will not qualify for the deduction, according to a cash document obtained by Fox News.

Here is the money that people of each state could pose under the savings of Trump “ Big Beautiful Bill ”

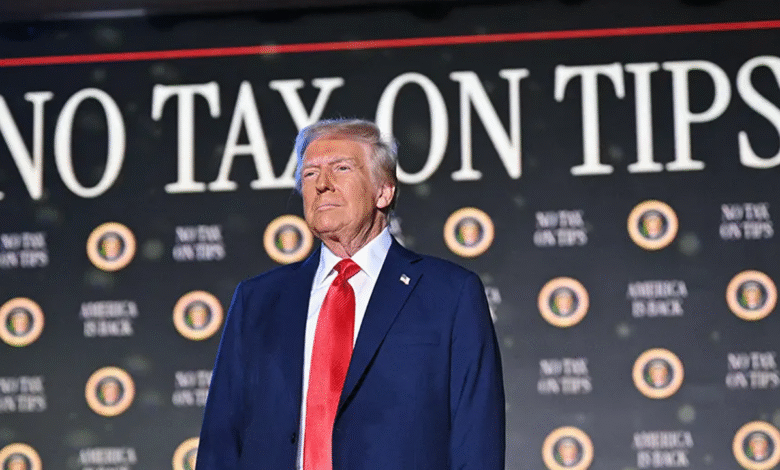

President Donald Trump arrives to talk about his policy aimed at putting an end to taxes on advice in Las Vegas, Nevada, on January 25, 2025. (Mandel Ngan / AFP via Getty Images)

The Treasury Secretary, Scott Bessent, told Rich Edson de Fox News that many workers collect overtime when working the Labor Day.

Trump signs the big and handsome ‘invoice in victory to sweep the program for the second mandate, overcoming the GOP DEMS and rebels

“The only major bill is not a tax on advice, no tax on overtime, no social security tax” and a deduction on car loans for American manufacturing cars, Bessent in Martin’s Tavern in Washington, DC on Monday.

Bessent said that the tax reduction on advice would “help the lowest 50% of the employees who have just been eviscerated under the Biden administration” and said that it was a way to fight against the “affordability crisis” in America.

The advice and overtime tax discounts will create real salary increases for the Americans who work, said the secretary to Fox News.

Among the eight sectors presented by the Treasury Department, several jobs should benefit from it.

For food and drinking services, barmans, waiting staff, food restaurants, chefs, fast food workers, dishwasher, bakers, host staff, restaurant, living room and coffee employees should not receive any tax on advice.

The secretary in the United States of the Treasury, Scott Bessent, is seen during an audience of the House Ways and Means Committee in Washington, DC, on June 11, 2025. (Eric Lee / Bloomberg / Getty Images)

With regard to the entertainment industry, play workers, dancers, musicians, singers, DJs, artists, digital content creators, lobby, bailiffs, ticket offices and changing rooms, corridors and dressing rooms, attendants will also likely be cashed in the tax cup.

Bellhops, Specifices, Hotel and Motel Desk Clerks and Houseparers should all benefit from it in the hotel sector.

In home services, repair workers, landscapers, electricians, plumbers, heating and air conditioning mechanisms and installers, installers or devices, home cleaning workers, locksmiths and road workers are all included.

For personal services and well-being industries, event planners, event photographers and videographers, personal care and services workers, event managers, pet guards, tutors, nannies and babysitters, skin care specialists, listed.

Golf caddies, self-enrichment teachers, recreational and touring pilots, tourist guides and escorts, travel guides and sports and leisure instructors can also expect a reduction in advice in the recreational profession.

A woman gives $ 100 to a bartender in this file photo. (istock)

Finally, for the transport and delivery industry, parking and valetables, taxi and carpooling drivers, drivers, shuttle drivers, delivery of goods, vehicle and personal equipment drivers, water taxi operators, charter boat workers, pedicab and cargo and cargo. benefit.

Congress unanimously adopted the Bipartisan No Act of Tax on Advice Separately from Trump’s “big and beautiful bill” earlier this year.

The Senate bill has established a new tax deduction of up to $ 25,000 for tips, but the One Big Beautiful Bill law does not include a ceiling on the tax deduction for slope wages.

Click here to obtain the Fox News app

While Trump’s Megabill clashed on partisan lines, the Democratic senators gathered behind the tax reduction for the councils, including the Democratic Senator of Nevada, Jacky Rosen.

“The Americans who work – servers to the barmans, the delivery drivers and everything else – work hard for each dollar they earn and are those who deserve tax reductions, not ultra -rich”, the head of the Senate minority, Senator Chuck Schumer, DN.Y., said earlier this yearcelebrating Rosen’s leadership to adopt the No Tax on Tips law.