The representative of Texas Moran unveils the law on the trust to use pricing income for the reduction of debt

NEWYou can now listen to Fox News articles!

First on Fox: The Texas representative, Nathaniel Moran, transforms prices into a debt reduction tool, revealing legislation that would channel billions of new commercial income into a trust fund aimed only at reducing the 37 billions of American dollars in America national debt.

The pricing income law used to secure tomorrow (the trust) would establish a special account in the Treasury Department called Tariff Trust Fund. From financial year 2026, any rate collected above the 2025 reference level would automatically enter this fund. According to the law, this money could only be spent in a way: reducing the federal deficit whenever the government presents itself in the red.

“The daring use of the prices by President Trump has already proven to be effective in bringing foreign countries back to the negotiation table and obtaining better commercial offers for America. This short -term success has produced record income, and now we have to make sure that Washington does not waste them,” Moran told Fox News Digital.

Trump says that we would be “destroyed” without pricing income

“The trust law guarantees that these dollars go where they are most necessary – by reducing our national debt and protecting the financial future of our nation.”

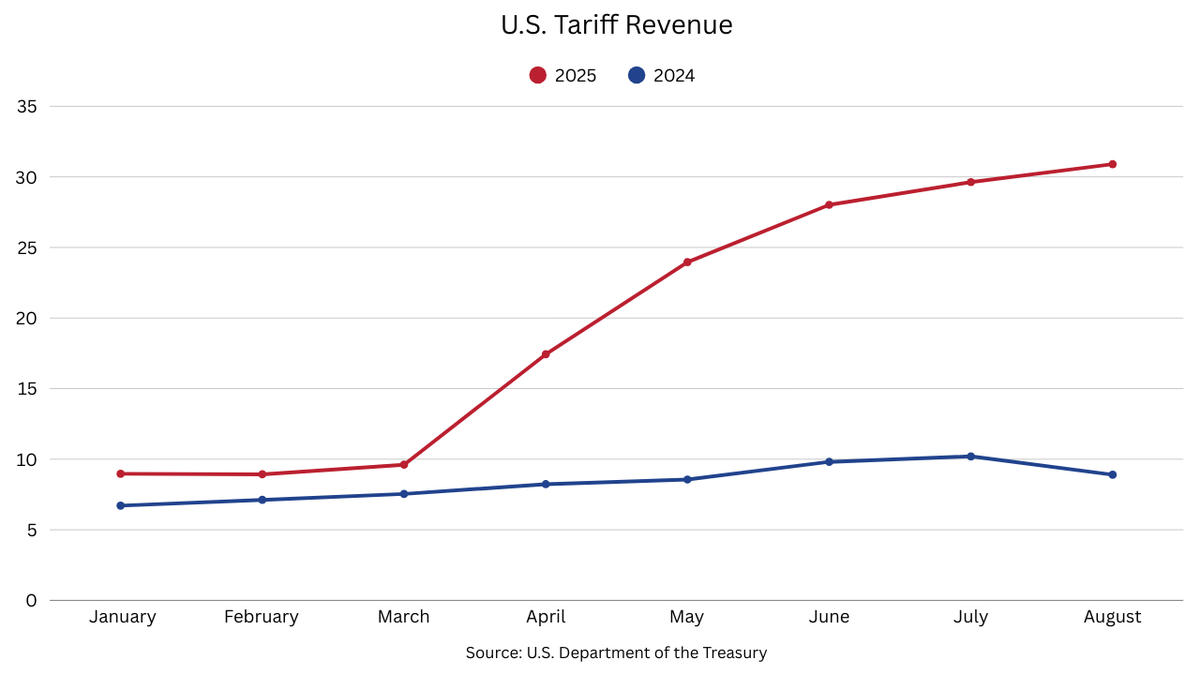

Moran legislation comes after the United States has collected more than $ 31 billion Price income In August, the highest monthly total so far for 2025. Total tariff income for 2025 reached more than $ 183.6 billion, according to data “Customs and certain taxes” published on August 29 by the Treasury Department.

Pricing income regularly increased from $ 17.4 billion in April to 23.9 billion dollars in May, before climbing $ 28 billion in June and reaching $ 29 billion in July. At the current rate, the United States could perceive as much pricing income in just four months to five months as during the previous year. At this stage of the fiscal 2024, pricing income was $ 86.5 billion.

Representative Nathaniel Moran, R-Texas, descends the steps of the House after the final votes in the Capitol before the Congress of October 25, 2024. (Images Bill Clark / CQ-Roll Call / Getty)

The sharp increase in income coincides with a decision of the Federal Court of Appeal that the President Donald Trump has surpassed his authority using emergency powers to impose radical world rates.

In its decision of August 29, the court declared that the power to set such prices rests squarely with the Congress or in existing commercial policy executives. The decision does not affect the prices imposed by other judicial authorities, such as Trump’s levies from imports of steel and aluminum.

Attorney General Bondi announced that the Ministry of Justice will appeal the decision to the Supreme Court. Meanwhile, the court has authorized the prices to remain in place until October 14.

A comparison from one year to the other of the tariff collections. (American treasure)

Treasury secretary Scott Bessent Previously, the Trump administration could apply part of the pricing income to reduce national debt.

The debt of the nation, which is the amount of money that the United States owes to its creditors, approach 37.4 Billions of dollars As of September 3, according to the Treasury Department.

The amazing figure has intensified the longtime debate in Washington on public spending, taxation and efforts to slow down the hot air balloon deficit.

The secretary of the Treasury Scott Bessent during a hearing of the Chamber of the Chamber Committee in Washington, DC, on June 11, 2025. (Eric Lee / Bloomberg / Getty Images)

Click here to obtain the Fox News app

“Comlace complacency is no longer an option. We have to act urgently and start reducing our national debt immediately,” added Moran in a statement.

Bessent also said the prices could generate more than $ 500 billion in revenue for the federal government. US companies pay these taxes to the federal government, but the cost often lies in consumers, because businesses increase prices to compensate for the economic burden.