Holiday commuting self-wrap supports the Trump car loans tax service

NEWYou can now listen to Fox News articles!

President Donald Trump Recognized Thursday a third -generation automotive worker from Michigan while speaking to the “Grand and Bel event”, noting that he was a life democrat who now supports the president due to the benefits of vehicle loans.

The president spoke of the “large and beautiful bill” of the room is from the White House with a group of people who stood behind him who represented various trades, including food delivery, farmers and car workers.

One of the workers standing behind Trump was James Benson, a third -generation automatic worker from Belleville, Michigan, who has been working at Ford Motor Company for 26 years.

Trump presented Benson, noting that Ford has “many plants” in the United States

Trump supporters defend the “ Big Beautiful Bill ” against Musk criticisms, raise the concerns of debt

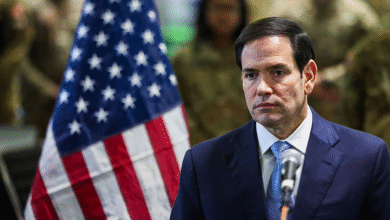

President Donald Trump is expressed during an event to promote his interior policy and his budgetary program in the east house in the White House on Thursday in Washington, DC (AP photo / Mark Schiefelbein)

“If you have plants in this country, you will earn a lot of money,” said the president, adding that he likes car workers.

Trump also said Benson was a Democrat for life until 2017, when he saw the advantages of tax laws.

Trump then spoke of his last plan for the benefit of car owners by making interest on the payments of the cars fully deductible from tax.

The “ One Big and Beautiful Bill “needs a makeover to inaugurate Trump’s golden age

The workers of a mounting chain of the Ford factory in Louisville, Ky., In 2017. (AP photo / Timothy D. Easley, file)

But the deduction would only be for cars made in the United States, said Trump, adding that if it was done elsewhere, “we don’t care”.

Trump’s “big and beautiful invoice” would create a new deduction of up to $ 10,000 for the loan interest of skilled passenger vehicles during a given taxable year. The deduction would eliminate when the changed gross income of a taxpayer exceeds $ 100,000.

Applicable passenger vehicles include cars, trucks, vans, SUVs and motorcycles that have been made for use in public streets, roads and highways and for which the final assembly occurs in the United States

Trump’s great bill faces the resistance of republican senators on debt fears

An income tax form 1040 and a W-2 salary declaration with a reimbursement check for the federal treasury. (istock)

The bill defines the final assembly as the process by which the manufacturer produces a vehicle and the book to a dealer with all the parts necessary for the operation.

As is the case with deductions on overtime and tips, the provision of car loans would be in force for the 2025 to 2028 taxation years.

Trump reiterated to those present that the tax service is only for vehicles made in the United States

Click here to obtain the Fox News app

“Remember that, James. We are going to roar these Michigan car factories,” said the president.

Eric Revell by Fox Business contributed to this report.